charity event cost calculator|How to Create a Fundraising Event Pricing Strategy [+ Examples] : Pilipinas Creating a nonprofit event budget allows you to strategize about producing an event that fits your fundraising needs and fits your supporter’s wallets. If your fundraising budget is top-heavy with expenses, consider hosting an . Phil heath no topo do fisiculturismo ganhando 7 Olympias seguidos. Seguindo sua jornada, foi em 2011 que Phil Heath alcançou o ápice de sua carreira ao vencer seu primeiro título de Mr. Olympia. Até esse instante, ele já tinha acumulado três participações no show, onde seu lugar mais alto foi em 2010, quando ficou em segundo lugar.

charity event cost calculator,Ago 9, 2021 — How to Calculate Fundraising ROI Step 1: Calculate your campaign’s costs (i.e. your ‘investment’). How should you calculate the costs of a particular fundraising .Abr 7, 2016 — As you embark on next year’s big fundraising event, don’t forget to calculate what your opportunity costs are. Are you able to make your event more efficient and .Okt 16, 2019 — 1. Calculate Event Costs. Estimate what your total costs will be for the event fundraiser. Depending on the type of event, this may include the cost of a location rental, supplies, permits, food, and .

Creating a nonprofit event budget allows you to strategize about producing an event that fits your fundraising needs and fits your supporter’s wallets. If your fundraising budget is top-heavy with expenses, consider hosting an .

Nob 8, 2023 — This includes the cost of acquiring items, event production expenses, marketing costs, rental fees, and more. By understanding your total costs, you can .CPDR is calculated by dividing the cost of your fundraising activities by the funds you raise. You can find the CPDR for specific campaigns or events, as well as your overall .

charity event cost calculator How to Create a Fundraising Event Pricing Strategy [+ Examples] May 30, 2023 — Determining the best ticket price for your nonprofit event can be complex. With a variety of factors to consider, figuring out what to charge your guests for a gala or .

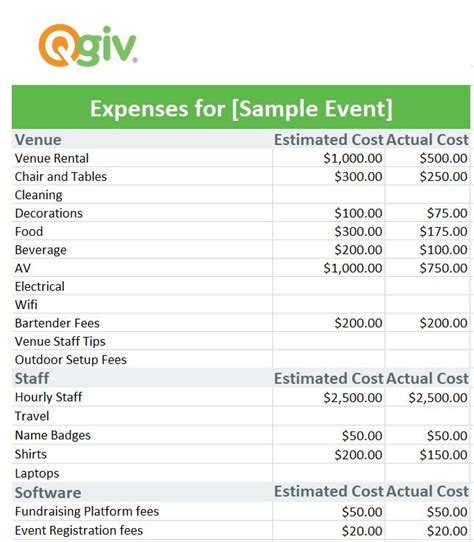

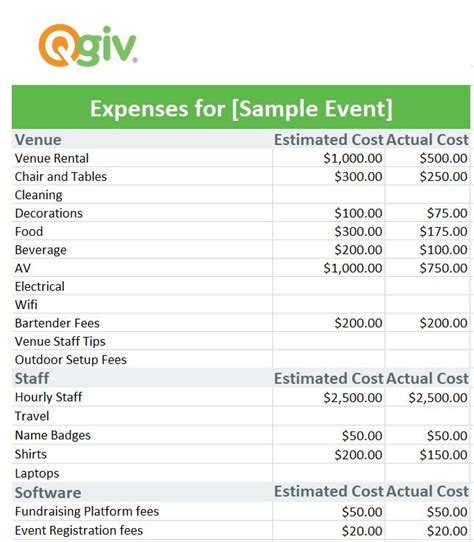

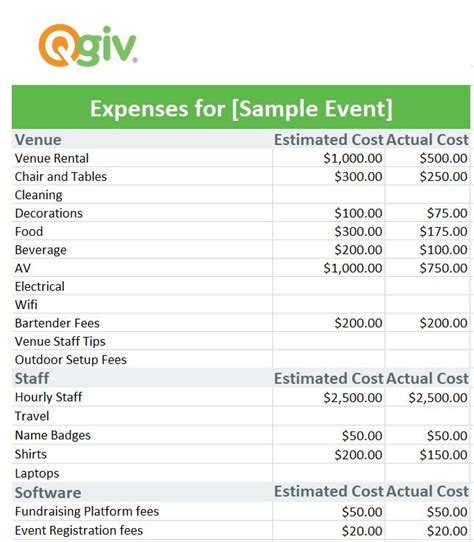

1. List the direct expenses associated with the event. This includes the cost of invitations and publicity, catering, entertainment and the venue you're renting. List any expense .

But what organizations also need to consider when planning an event, especially for the first time, is how to calculate the tax-deductible portion of the price of admittance for .

Also known as the “fundraising multiplier”, this is a measure of the effectiveness of fundraising and can be calculated overall or by event / activity. It calculates the “return on investment” or “ROI” of the various fundraising activities carried out, and the higher the number above 1, the more successful the fundraising activity .

The charity cares because it would rather have contribution income to apply toward its public support calculation than unrelated business income which could be taxable or “other income” (if the event is not “regularly carried on”) which would be adverse in the public support calculation.

Mar 20, 2007 — A lower ticket price may help raise attendance and may be necessary for some types of events. For example, an outdoor arts festival would naturally be very limited on what could be charged at the gate. Other types of events have much more latitude on the event ticket prices. Gala events vary greatly in prices from $50 per person to in the .charity event cost calculatorAbr 18, 2024 — Charitable contributions are generally tax-deductible if you itemize. The amount you can deduct may range from 20% to 60% of your adjusted gross income.Set 15, 2008 — About 60,000 of the 82,000 charities have zero fundraising costs (line 5020). About 32,000 charities have no management and administration expenditures (line 5010). Some charities may be able to have overhead of 10-15 percent, but many will quite legitimately have higher overhead expenses more in the range of 20-35%.

Ago 29, 2023 — As part of your event cost breakdown, it’s critical to differentiate between fixed costs and variable expenses. . These costs are calculated as a total amount. Variable costs are event expenses that change based on the number of attendees. These costs are calculated on a per-person basis. Example: Number of People: 200: 400:Set 16, 2019 — Another way to calculate event ROI is dividing the total revenue by the total event cost. The resulting number is expressed in pounds e.g. £2.50 was generated for every £1 invested. Using these easy calculations, you can set out at the start of planning your event what you hope to achieve in terms of ROI. Conclusion

How to Create a Fundraising Event Pricing Strategy [+ Examples] The offering includes Microsites, white label fundraising and event reg and custom map-based challenges. Learn more Speak to an expert. Pricing breakdown. Mass Participation . Net donation amount. Ticketing fee. Merchandise fee. Paying in fee. Cost to charity. Donor option to leave a voluntary tip. 0%. 1.9% + 20p. 5%. 121.5%. N/A. N/A. 5%. £ .

We calculate an organization's fundraising efficiency by determining how much it spends to generate $1 in charitable contributions. We calculate the charity’s average fundraising expenses and total contributions over its three most recent fiscal years and then assign a numeric score based on an established scale.Accounting and Reporting by Charities. Accounting for costs shared between fundraising and charitable activities. 8.10. Information about the aims, objectives and projects of a charity is frequently provided in the . activities and any estimation technique(s) used to calculate their apportionment; • the total amount of support costs .

Your event budget is the first step in your event planning because it lays out your projected expenses and income. If your projected income doesn’t match the projected cost of your proposed event, that spells trouble. .

Organizer Fees Organizer Fees are associated with publishing events on our platform. For events with 25 tickets or fewer, it’s free to publish your event. For larger events, you can opt for Flex, a pay-as-you-publish plan with a one-time fee per event.Nob 8, 2023 — Fair Market Value (FMV) represents the perceived worth of items, services, or experiences offered at a fundraising event. It is distinct from the actual cost of organizing the event. While the event's cost reflects expenses incurred, FMV determines the value of what attendees receive in return for their contributions. 2.

Please note that the long-term capital gains tax rates depicted in the Appreciated Assets Donation Calculator do not take into consideration that long-term capital gain income may also be subject to an additional 3.8% Medicare tax for taxpayers with income at or above a certain threshold.A charitable remainder trust calculator that allows charitable and philanthropic individuals as well as non profit organizations to measure potential tax benefits and growth projections of a charitable remainder trust strategy. . This is the cost basis of the charitable contribution. This is used to determine long term capital gains tax .Charity benefit events. . You can claim your travel expenses as charitable contributions, but you can't claim the cost of your evening at the theater. . Calculation. Summary: This is the calculation used to figure the adjusted basis of the contributable amount of property. To calculate: Multiply the Adjusted basis of entire property by (the .After entering this information, click on the ‘Calculate’ button to see the total estimated cost of catering for your event in the Result field. How It Calculates the Results. The calculator multiplies the number of guests by the price per person depending on the menu type chosen. For full-service, an additional flat fee is added to the .Nob 24, 2023 — CPA is the total cost of your event divided by the total number of attendees. For example, if you spend $10,000 on your event and have 200 attendees, your CPA is $50.

charity event cost calculator|How to Create a Fundraising Event Pricing Strategy [+ Examples]

PH0 · Ticket Pricing for Nonprofit Events

PH1 · How to Determine Fair Market Value of Fundraising Event Via

PH2 · How to Create a Fundraising Event Pricing Strategy [+ Examples]

PH3 · How to Calculate the Expense to Revenue for Nonprofit Events

PH4 · How to Calculate Fundraising ROI: Quick Guide for Nonprofits

PH5 · How to Calculate Event Fundraising ROI

PH6 · How to Calculate A Fundraising Event's Opportunity Cost

PH7 · How To Create a Nonprofit Event Budget

PH8 · Evaluating the Fair Market Value of Special Events

PH9 · Calculating your fundraising Cost Per Dollar Raised